Our stock trading strategies are based on surprisingly simple yet effective no nonsense logic that is uncommon in the stock market. For our short term trading strategy we: Buy at support; we take small, quick profits; and we use the 10/2 rule so that we never slip backwards.

Friday, December 29, 2006

Happy New Year!

In other words, so many are expecting a bearish start to the new year, that it is likely just the opposite will occur. We wouldn't be surprised if the market continues to struggle a bit near term, but intermediate term technicals are firming up and show that there is a good chance that the market, including the QQQQ may be ready to breakout.

Thursday, December 28, 2006

Small Caps Breaking Out or Breaking Down?

Note the fact that the last time the IWM peaked its head above resistance spring of last year. The breakout failed big time and small caps went into a tail spin. Volume since that time has been overwhelming large so either smart money is accumulating small cap stocks for a big run or they are unloading their shares in expectation of an even bigger failure than last spring's failed breakout. The jury is still out for us.

Wednesday, December 27, 2006

Momentum Scarce this Holiday Season

Taking a look at the longer term charts we can see a potential scenario shaping up. The QQQQ, as mentioned, lagged yesterday. If you look at the weekly chart it appears to be building a base that could take a few weeks to form. During this base building process, prices could potentially dip down to $42. As long as $42 holds, assuming this scenario is correct, stocks could rally strong mid to late January.

If indeed this is what is taking place, we would expect the S&P and Dow to trade sideways or dip slightly in a grueling base-building process over the next few weeks. As yet, we are not seeing any serious distribution, just a slowing down of momentum that is likely the beginning of a consolidation period.

This week the market should continue to rally, but from what we saw yesterday, the rally may not get far and profit potential is not very strong. This is a stock picker's market right now and just a handful of stocks are showing any real potential.

Tuesday, December 26, 2006

Subscriber Notes

Friday's Breakdown Likely to Get Faded

1. Seasonality: This week between Christmas and New Year is traditionally positive and seasonality factors are particular strong and trustworthy this time of year. This does not mean that this year won't be different, just that the probabilities favor a rally. 2. This is the first time that the QQQQ has pulled back to its 50-day average since the bull market began in August. Pull back buyers defend the 50-day average in bull markets. 3. Oscillators are very oversold at this point. Now understand, oscillating indicators can and do stay oversold for very long periods of time in some markets. However, this usually occurs when the market is trending down. During an uptrend, oversold oscillators are buy signals and at a minimum should not be shorted.

Today: Don't be surprised if the market opens weakly today. In fact, we hope that it does. Weak opens at the beginning of the week typically invite buyers who fade the early weakness causing a strong rally to ensue.

If, however, the market does bounce here, but does not find any follow through buying higher, we will need to reevaluate our bullish posture. This is just an "if" at this point.

Friday, December 22, 2006

Random Trading Offers Chance to Take Off Early Today

The market is in random walk mode as it ranges within the trading range. Professional money managers who have not yet taken off for the holidays are quite likely to take off today. Volume should be especially low today and price action should be fairly meaningless. This is not an environment to open new trades in.

In fact, why trade at all today? Take off early with the professional money managers. Go home and enjoy your families. Get an early start on that weekend road trip you were planning. Have a wonderful holiday weekend. We plan to. We also wish everyone the best and hope everyone stays safe and has a great holiday.

Thursday, December 21, 2006

Rangebound Through the Holidays

QQQQ Range: $43.35-$44.75

Wednesday, December 20, 2006

Thailand Could Have Hurt, but it Didn't

This appears to be a market that maintains full rally mode and the uptrend remains in tact and in good shape. There is still a lot of money on the sidelines that can be put to work at higher prices so once again, the trend is your friend and your friend is bullish.

Tuesday, December 19, 2006

Choppy Market Ahead

Money managers, who need to have their money working at the end of the year are parking it in low beta, heavily traded blue chip positions while they are in a mad scramble to unravel their riskier small and mid cap positions.

Selling pressure was felt across the board and should be respected. Nevertheless, bears who sold short yesterday are likely to get burned as market players use the low volume holiday environment to run the stops. That is, new short positions will have stops placed at overhead resistance levels creating a big temptation for hedge funds to run prices back up and collect the stops before they enter their own short positions.

We expect that the market will see a turnaround Tuesday today where yesterday's losses move back into positive territory. This may be a chance to exit long positions and put on shorts of our own. We will need to wait and see how furious the buyers are as they play their hand.

Right now it is absolutely essential to stay patient and not open any new positions. A weak bounce today would be a good opportunity to open some shorts, but as of the time of this writing there are no advantages afforded anyone but the scalpers.

Note to Gold and Bronze members: We plan to issue an update on open long term positions either today or tomorrow. We are waiting for more data before adding to current commentary.

Monday, December 18, 2006

Taking a Cautious Approach Today

The reason that follow through is important here is it helps us determine if Thursday's rally was merely shorts covering after their stops were triggered or if there remains significant buying interest at these levels. There wasn't much buying going on Friday so we need to heed the warning here.

Trading volume is likely to be weak this week as traders start heading for the exits early to go home and enjoy the holidays. In such an environment it is best to wait and gather as much data as possible before making further decisions. That's what we suggest doing today, waiting for more data (i.e., today's trading results) before making any further moves.

Friday, December 15, 2006

Santa Arrives

Those doubting this rally will continue to bite their lips as prices continue higher. Even so, this rally should be treated as if it were the end game. It may or may not be, but while good short term trading opportunities are presenting themselves here, a longer term reversal may be developing. Don't be afraid to buy here, but just be aware of the reversal potential and be ready to take profits into continued strength.

Thursday, December 14, 2006

Basic Materials Remains the Place to Be

We will probably get a Santa rally over the next few weeks, but the real strength has come from a rotation into the oils and other basic materials (except steel, which suffers from a poor outlook from sector leader NUE). As such, we should see the indices rise into January, but trading is going to be tough for those outside of the basic materials sectors, with just a few exceptions.

The failure of the semiconductors to participate in yesterday's late market strength is telling. Trading tech is sure to cause continued pain and frustration.

Note: We sent a near term recommendation to subscribers today. Please check your email for details.

Wednesday, December 13, 2006

Update After the Open Today

Nevertheless, the market has yet to digest the Fed meeting minutes released yesterday afternoon. The initial reaction generally is meaningless so today we will see what the market really thinks about yesterday's minutes.

We will be providing another update after the market opens when we can get a handle on what type of sentiment we will see following yesterday's important market moving event. We plan to provide updates on open near term selections between 10:30a.m. and 11:00a.m. today.

Tuesday, December 12, 2006

Fed Watch Today

The broader market is set up for an upside breakout here, but the potential for a fade (where sellers use the breakout to sell) is strong here. If indeed the broad market breakout does fail it should bolster support in the oil stocks, which have been enjoying a slow rotation as profits earned in the blue chips have been moving into the energy sector.

Monday, December 11, 2006

Tech Weak, but not Broken

Oil is coming under a bit of pressure, but most oil sector stocks are consolidating nicely so we expect the pressure to find dip buyers.

Gold prices are likely to come back to support from current levels, but gold stocks seem to be moving contrary to the dollar right now and not the price of gold itself. The dollar has been in a tail spin and its recent weak bounce is likely to be met with more selling. Next month, however, there seems to be potential for the dollar to find support and rally, which means it's probably a good idea to sell into the next round of strength in the mining sector.

Friday, December 08, 2006

Employment Report Should be a Market Mover

Thursday, December 07, 2006

Watch the Lower High

Wednesday, December 06, 2006

Commodities, Commodities, Commodities...

The NASDAQ on the other hand is vulnerable to some sort of correction. We however continue to believe that bulls maintain the upper hand and the trend remains up. The trend break mentioned earlier in the week has resolved itself as dip buyers once again fed a spoonful of pain to the shorts.

Our question is, why short when there are so many great opportunities to go long in the oils and metals? We suppose there is a natural competitive tendency to want to call the top and prove one's self superiority over others by being the smartest one in the herd. The temptation has been a very destructive one for four months now. And, with the trend aging in people's minds, the temptation is probably stronger now than ever.

We've said it before and we will say it again. Tops take time to build and shorting a strong uptrend is a loser's game.

Note: A near term stock selection has been sent to subscribers. Please check your email for details.

Tuesday, December 05, 2006

Commodities Continue to Heat Up

Monday, December 04, 2006

Energy Heating Up

Friday, December 01, 2006

Broad Market Trend May be in Trouble

Thursday, November 30, 2006

Tuesday was but an Aberration

Wednesday, November 29, 2006

Looking for Consolidation

Monday, November 27, 2006

QQQQ still in Line for $45.50

Wednesday, November 22, 2006

Holiday Rally Underway

Tuesday, November 21, 2006

Broad Market Trend Showing Signs of Aging

Not much has changed since Friday's trading, so we will keep this brief and just summarize the current environment.

The QQQQ has a likely target of $45.30-$45.50. Given the money flow erosion on the Dow and the fact that other world markets are now breaking down (

Monday, November 20, 2006

Holiday Week Tends Towards Bullishness

Friday, November 17, 2006

Sitting Tight Through Today's Expiration

The QQQQ continues to be due for a pull back to its uptrend line provided in Wednesday's report. Continued gains from this level without a pull back make for an unstable climb, which would leave it more vulnerable for a hard correction. Despite the fact that this trend has been alive for longer than we have been used to trends lasting over the past couple of years, most technicals are in pretty good shape. Beyond that, we will refrain from calling a top. So many analysts continue to call for a top and as such have kept their followers from participating in this trend. Stops will take us out when the trend reverses. Once again, price is king and price remains solidly up.

As for today, today is options expiration and we tend to like to sit back and wait out this day each month. Options week is hard enough to navigate and on the day of expiration, price action can be even more meaningless. Next week is a short week as well, so it's a good idea to manage open positions and not open anything new unless something extraordinary presents itself.

Have a great weekend everyone!

Thursday, November 16, 2006

Charts Continue to Look Healthy, but Expect Consolidation

Wednesday, November 15, 2006

QQQQ Has Room to Move

From the chart above you can see that the immediate trend doesn't have much more room to spare before a correction takes place. Panning back to a 5-year view however note that the QQQQ is gunning for its overhead channel resistance. Sine 2004 the channel top drawn on the chart below has been turning back the QQQQ. Over the coming weeks this resistance area of $45.50 should act as a price magnet. What happens after the QQQQ reaches this area is anyone's best guess. It is interesting to note, however, that the S&P and Dow have both taken out their overhead channel resistance and are continuing higher. It's too early to know if this has any real significance. For now though, the trend remains friendly to bulls.

Tuesday, November 14, 2006

Maximum Pain Could be Painful for Bulls Friday

Monday, November 13, 2006

Outlook Grows Surprisingly Bullish

Thursday, November 09, 2006

Market Continues to Rally

Wednesday, November 08, 2006

Government Gridlock Likely Priced In

Tuesday, November 07, 2006

Dull Day Likely

Monday, November 06, 2006

Friday's Jobs Report Changed the Outlook

Friday, November 03, 2006

It's not the Data, but the Market's Reaction that Matters

Thursday, November 02, 2006

Recession Watch Heats Up

Wednesday, November 01, 2006

Can Microsoft Save the QQQQ?

Tuesday, October 31, 2006

Probably a Top, But Tops Take Time to Form

Monday, October 30, 2006

Economic Trend in Rapid Decline

Thursday, October 26, 2006

Top Callers Continue to Take on Haphazzard Shorts

Wednesday, October 25, 2006

Probabilities for a Correction Increase - But Don't Short Yet

Tuesday, October 24, 2006

Dip Buying Remains Strong

Monday, October 23, 2006

Trends are Bullish, but Extended

Thursday, October 19, 2006

Dip Buyers Continue to be Relentless

Wednesday, October 18, 2006

Waiting on the CPI Reaction

Tuesday, October 17, 2006

Be Slow to Become Bearish

Monday, October 16, 2006

Charts are Great, but Protect Your Gains

Second, just because resistance is overhead and indices are not likely to make much progress, trade what is in front of you. If set ups are good, take them and protect yourself with a good stop loss strategy. Right now set ups are very good. Yes prices may turn at any time, but no one made any progress in the market worrying about what "could" happen. You have to take the opportunities that the market gives you and protect yourself against the turns by using good risk management.

Second, just because resistance is overhead and indices are not likely to make much progress, trade what is in front of you. If set ups are good, take them and protect yourself with a good stop loss strategy. Right now set ups are very good. Yes prices may turn at any time, but no one made any progress in the market worrying about what "could" happen. You have to take the opportunities that the market gives you and protect yourself against the turns by using good risk management.

Friday, October 13, 2006

Next Friday's Expiration May Cause Shorts Pain

Thursday, October 12, 2006

The Trend Remains Long Friendly

Wednesday, October 11, 2006

Keeping the Big Picture in Mind as the Market Climbs

Tuesday, October 10, 2006

No Update Today

Monday, October 09, 2006

Bulls in Control, but This is Their End Game

Friday, October 06, 2006

Why Wednesday's Changed the Outlook

Thursday, October 05, 2006

Bulls Deliver a Potential Knockout Blow

Wednesday, October 04, 2006

Is a Rising Dow Bullish?

Note that the QQQQ accomplished the first leg (the up arrow) in the scenario provided yesterday. Now we wait to see if it will indeed be turned back at this area.

Tuesday, October 03, 2006

Bulls and Bears Likely to Be Frustrated this Week

Second, too many traders have been waiting for this break and put options sales were through the roof yesterday as a result of the break. When too many people in the market are looking for the same thing, the perverse nature of the market is to deny the crowds their satisfaction. We scanned everything today and there are just not good chart set ups out there despite the QQQQ breakdown yesterday. Longs are very likely to be frustrated as rally attempts should now get turned back at resistance. Likewise, eager shorts are likely to be frustrated today as follow through from yesterday's breakdown is unlikely. Very often when a major breakdown occurs, the underside of support is tested before the trend can establish itself. Evidence points to a test of resistance that gives false courage to bulls and frustrates overly anticipatory bears before the market can move lower.

Monday, October 02, 2006

Friday Was Probably Meaningless

Friday, September 29, 2006

Sentiment Readings Near Dangerous Levels

Thursday, September 28, 2006

Selling Tech

For the second week in a row the SMH has been rejected at $35. Yesterday's hard reversal and failure to bounce at the end of the day even as the broader market recovered somewhat, is the canary in the mine that has stopped singing. This sector is the leading indicator for the broader tech sector and this sector tells us that tech is weak.

Tops take time to form, but while the blue chips are working out their top, we suspect that, like the last top in April the QQQQ will start to come down early.

For the second week in a row the SMH has been rejected at $35. Yesterday's hard reversal and failure to bounce at the end of the day even as the broader market recovered somewhat, is the canary in the mine that has stopped singing. This sector is the leading indicator for the broader tech sector and this sector tells us that tech is weak.

Tops take time to form, but while the blue chips are working out their top, we suspect that, like the last top in April the QQQQ will start to come down early.

Wednesday, September 27, 2006

Time for Caution

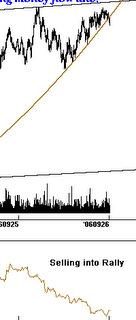

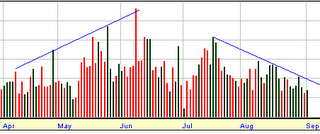

Also note the important break in the uptrend line yesterday, even as QQQQ shares traded higher. Adding insult to injury, the S&P 500 made a new 5-year high yesterday, while the NASDAQ lagged significantly. This type of bearish divergence has preceded each failed rally for several years now. Gaming Window Dressers: End of month window dressing has been increasingly gamed by traders who have learned the pattern. Not that long ago window dressing would result in rallies which took place during the last three days of the month, and sometimes extended into the first two trading days of the following month. Now, however, traders have been taking advantage of the rallies and selling into them during the later days, causing the rallies to start to fizzle during the last day or two of the month. If this pattern persists, it means that today should market the last day where window dressing is able to push the market higher. S&P Rising Wedge: One of the most bearish of all rally patterns is the rising wedge, a pattern we have highlighted several times over the past few weeks in the S&P 500 index. We have hypothesized that before this wedge gives way to selling, a strong upside breakout would occur in order to draw in bag holders. Yesterday we got the initial move of just such a breakout, as can be seen below.

Time for Caution

Also note the important break in the uptrend line yesterday, even as QQQQ shares traded higher. Adding insult to injury, the S&P 500 made a new 5-year high yesterday, while the NASDAQ lagged significantly. This type of bearish divergence has preceded each failed rally for several years now. Gaming Window Dressers: End of month window dressing has been increasingly gamed by traders who have learned the pattern. Not that long ago window dressing would result in rallies which took place during the last three days of the month, and sometimes extended into the first two trading days of the following month. Now, however, traders have been taking advantage of the rallies and selling into them during the later days, causing the rallies to start to fizzle during the last day or two of the month. If this pattern persists, it means that today should market the last day where window dressing is able to push the market higher. S&P Rising Wedge: One of the most bearish of all rally patterns is the rising wedge, a pattern we have highlighted several times over the past few weeks in the S&P 500 index. We have hypothesized that before this wedge gives way to selling, a strong upside breakout would occur in order to draw in bag holders. Yesterday we got the initial move of just such a breakout, as can be seen below.

Tuesday, September 26, 2006

As Long as Everyone is Bearish, This Rise Will Continue

Monday, September 25, 2006

Window Dressing Should Prop Up Weak Market

There remains potential for the S&P to test its highs this week. We will be surprised, but not completely shocked, if the QQQQ is able to also test its highs. We would use late week strength to look for short positions.

Finally, for those feeling a twitch of concern at our market outlook, consider that after a corrective retracement, the probabilities for a strong late year rally are very good.

There remains potential for the S&P to test its highs this week. We will be surprised, but not completely shocked, if the QQQQ is able to also test its highs. We would use late week strength to look for short positions.

Finally, for those feeling a twitch of concern at our market outlook, consider that after a corrective retracement, the probabilities for a strong late year rally are very good.

Friday, September 22, 2006

Market Cracks Some More

Thursday, September 21, 2006

SMH Fails to Make a New High

Wednesday, September 20, 2006

Monday's Scenario Still In Play

Tuesday, September 19, 2006

Buyers Still in Control/Tech May Have a Top

Monday, September 18, 2006

Support Test Coming Up

The QQQQ set up is a little more unclear as it has shown good relative strength lately.

The bottom line: We are seeing some good long set ups at this time that should continue higher over the next couple of weeks. As we enter October the market becomes more vulnerable to a larger correction. Should the above scenario play out like it looks like it might, the return to the summer lows will provide an excellent long term buying opportunity. Participants are likely to be extremely bearish at that point and those who play it cautious as the market makes its top here will be in great shape to capitalize at very good prices indeed.

The QQQQ set up is a little more unclear as it has shown good relative strength lately.

The bottom line: We are seeing some good long set ups at this time that should continue higher over the next couple of weeks. As we enter October the market becomes more vulnerable to a larger correction. Should the above scenario play out like it looks like it might, the return to the summer lows will provide an excellent long term buying opportunity. Participants are likely to be extremely bearish at that point and those who play it cautious as the market makes its top here will be in great shape to capitalize at very good prices indeed.

Friday, September 15, 2006

Watching and Waiting

Thursday, September 14, 2006

Pavlov's Lesson

Wednesday, September 13, 2006

Bulls Refuse to Give Up

Tuesday, September 12, 2006

Watching Tech's Head and Shoulders

Monday, September 11, 2006

Three Potential QQQQ Scenarios

If this is indeed the case, we should see the price bounce around between $38.00-$38.70 through options expiration, and then potentially break lower. Cup and Handle (bullish)

Friday, September 08, 2006

No Advantages to Forcing a Trade

Thursday, September 07, 2006

Stay Patient, Sentiment Will Swing Again

The tech sector will probably bounce from yesterday's lows, but now any rally attempts are very likely to get stuck in the mud and prices will begin working their way lower; frustrating any hopeful longs who buy the dips.

The SPY (S&P 500) moved down to support yesterday, but it has not yet provided a sell signal. Money flow perked up at the end of the day indicating that smart money has not yet determined that the rally is completely played out. There are just too many retail traders who have quickly jumped to the bear camp after yesterday's weakness. The market's perverse nature is likely to frustrate put option buyers by failing to provide immediate gratification.

If the SPY can break below the blue uptrend line it closed at yesterday, it will signal a sell.

The tech sector will probably bounce from yesterday's lows, but now any rally attempts are very likely to get stuck in the mud and prices will begin working their way lower; frustrating any hopeful longs who buy the dips.

The SPY (S&P 500) moved down to support yesterday, but it has not yet provided a sell signal. Money flow perked up at the end of the day indicating that smart money has not yet determined that the rally is completely played out. There are just too many retail traders who have quickly jumped to the bear camp after yesterday's weakness. The market's perverse nature is likely to frustrate put option buyers by failing to provide immediate gratification.

If the SPY can break below the blue uptrend line it closed at yesterday, it will signal a sell.

Wednesday, September 06, 2006

Be Careful Here

Tuesday, September 05, 2006

What September May Hold

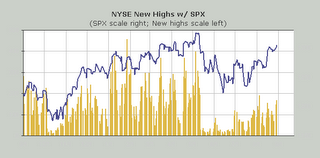

2. Likewise, the S&P 500 and Dow have rallied back to their April failure points. However, note the notable decrease in stocks making new highs during the latest rally (the yellow bars represent stocks making new highs, while the blue line represents the S&P price levels). This is a very strong bearish divergence, which makes a breakout to new highs very unlikely.

Thursday, August 31, 2006

Watch the SMH for Signs of Profit Taking

Wednesday, August 30, 2006

Watch Out for Rising Wedges

Now take a look at the current S&P chart, represented below by the SPY (ETF) exchange traded fund.

The wedge here is in a much sharper uptrend, but the price is contracting nonetheless. Could the bulls rally the price of the SPY back up to $132? We don't know yet. But if they did, there would surely be a great deal of capitulation amongst the shorts. Likewise, given the low volume in which this steep climb has been driven with, the probable reversal could be sharp and swift. Now turn your attention to the QQQQ, which has been behaving a little better lately. Below we are providing a weekly view of this ETF. Note the red line on the chart just above $39. This represents the 50-week average. Note also the blue trend line drawn on the chart. This line represents the last broken uptrend. Stocks and indices often move back up to retest their broken trends before reversing. We don't know what exactly to expect next, but it is clear that any further rally from yesterday's close is sure to run head long into some serious resistance.

Finally, let's take a look at the semiconductor sector, represented below by the SMH ETF. The semiconductors actually look pretty good lately. They appear to be in a decent uptrend that is rising on decent volume. Also note, however, that yesterday's sharp move put the sector right near overhead resistance, as represented by the rising trend channel. Furthermore, $34.28 represents the broken 200-day average. Thus, any further rallies in this sector are also likely to run into heated resistance.

The semi conductors could actually produce some good long side trades after a pull back if it is orderly. For now it is too late to try and catch this trend.

Bottom line: Professional traders are expected to return next Tuesday after the holiday weekend. Any breakout attempts following yesterday's strong close should be eyed very suspiciously. No one knows for sure what will develop next week, but several indices are poised for serious downside if the pros come back with selling on their minds. If, on the other hand, they come back in a buying mood, further upside is likely to be muted by serious overhead resistance. In other words, be extra cautious if you are trading the long side of this market and don't get too aggressively short unless we see some breakout failures start to emerge.