Today large money managers return from vacation in droves after spending the hot months of August in their vacation homes. Below we are listing our reasons for why we believe the institutions will unload their positions in September and why we believe that an excellent buying opportunity is coming later in the month. So, if you missed the latest rally out of distrust like we did, never fear, there will be a second and better chance to participate at perhaps even cheaper prices.

Reasons we are looking for a decline from here:

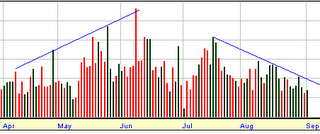

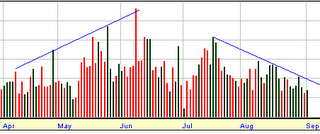

1. During the last two weeks of August the market rallied, but on decreasing volume. The QQQQ rallied right into its broken 200-day average. Take a look at the volume patterns during the decline from April and the late summer rally. Note the increase in sellers on the way down and the decrease in buyers on the way back up.

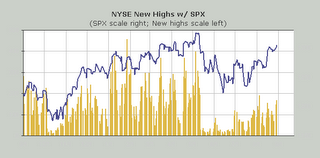

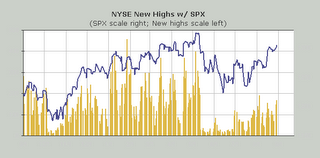

2. Likewise, the S&P 500 and Dow have rallied back to their April failure points. However, note the notable decrease in stocks making new highs during the latest rally (the yellow bars represent stocks making new highs, while the blue line represents the S&P price levels). This is a very strong bearish divergence, which makes a breakout to new highs very unlikely.

3. September has traditionally been the worst month of the year. This September the market is facing an additional seasonal factor, the reliable 4-year cycle. Longs have thus far done a great job at shaking out early shorts from their positions, which is generally what happens right before a large market move.

4. Overly bearishness has given way to overly bullishness. Last week Baron's magazine was cheering on the market as it approaches new highs. Money managers have a perfect opportunity to book profits into the crowd's enthusiasm.

5. Market volatility levels are back near all-time lows; another measure of the crowd's complacency as the market moves back up to test its highs. Bull markets climb walls of worry, and there is just not enough worry to move the market through the ceiling.

Summary: Given the fact that the market has rallied for two weeks on low volume, that fewer and fewer stocks are making new highs even as the indices are nearing their highs, and now that the crowd is getting excited, it's a good time for the 4-year cycle to reassert itself.

Outlook: Not all is bleak. Tech has shown some excellent relative strength and there are murmurings now that the Fed will once again start lowering rates to stave off an impending recession next year. The bond market has been behaving in such a way as to indicate this is true. September could be an ugly month for the bulls, but if the market is able to move back down to its June and July lows, we will be buying madly as this will mark a clear opportunity to take advantage of what is shaping up to be a strong rally in coming months.

If you are worried about the market, make sure you are not mixing up your time frames. The outlook is pretty bearish directly ahead, but not so many weeks out in front, the outlook becomes much more bullish.

Today: As we mentioned, the financial magazines and the crowds are fairly bullish after last week's strong close. The S&P looks like it wants to make a run back at its May highs. Meanwhile, money managers are going to come back looking to book profits made by their assistance and programs over the past few weeks. Early week enthusiasm then makes for a very nice opportunity to sell into strength. For the reasons we outlined in today's report, any further strength is not to be trusted.

No comments:

Post a Comment