Our stock trading strategies are based on surprisingly simple yet effective no nonsense logic that is uncommon in the stock market. For our short term trading strategy we: Buy at support; we take small, quick profits; and we use the 10/2 rule so that we never slip backwards.

Friday, September 29, 2006

Sentiment Readings Near Dangerous Levels

Thursday, September 28, 2006

Selling Tech

For the second week in a row the SMH has been rejected at $35. Yesterday's hard reversal and failure to bounce at the end of the day even as the broader market recovered somewhat, is the canary in the mine that has stopped singing. This sector is the leading indicator for the broader tech sector and this sector tells us that tech is weak.

Tops take time to form, but while the blue chips are working out their top, we suspect that, like the last top in April the QQQQ will start to come down early.

For the second week in a row the SMH has been rejected at $35. Yesterday's hard reversal and failure to bounce at the end of the day even as the broader market recovered somewhat, is the canary in the mine that has stopped singing. This sector is the leading indicator for the broader tech sector and this sector tells us that tech is weak.

Tops take time to form, but while the blue chips are working out their top, we suspect that, like the last top in April the QQQQ will start to come down early.

Wednesday, September 27, 2006

Time for Caution

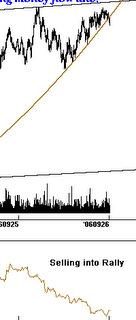

Also note the important break in the uptrend line yesterday, even as QQQQ shares traded higher. Adding insult to injury, the S&P 500 made a new 5-year high yesterday, while the NASDAQ lagged significantly. This type of bearish divergence has preceded each failed rally for several years now. Gaming Window Dressers: End of month window dressing has been increasingly gamed by traders who have learned the pattern. Not that long ago window dressing would result in rallies which took place during the last three days of the month, and sometimes extended into the first two trading days of the following month. Now, however, traders have been taking advantage of the rallies and selling into them during the later days, causing the rallies to start to fizzle during the last day or two of the month. If this pattern persists, it means that today should market the last day where window dressing is able to push the market higher. S&P Rising Wedge: One of the most bearish of all rally patterns is the rising wedge, a pattern we have highlighted several times over the past few weeks in the S&P 500 index. We have hypothesized that before this wedge gives way to selling, a strong upside breakout would occur in order to draw in bag holders. Yesterday we got the initial move of just such a breakout, as can be seen below.

Time for Caution

Also note the important break in the uptrend line yesterday, even as QQQQ shares traded higher. Adding insult to injury, the S&P 500 made a new 5-year high yesterday, while the NASDAQ lagged significantly. This type of bearish divergence has preceded each failed rally for several years now. Gaming Window Dressers: End of month window dressing has been increasingly gamed by traders who have learned the pattern. Not that long ago window dressing would result in rallies which took place during the last three days of the month, and sometimes extended into the first two trading days of the following month. Now, however, traders have been taking advantage of the rallies and selling into them during the later days, causing the rallies to start to fizzle during the last day or two of the month. If this pattern persists, it means that today should market the last day where window dressing is able to push the market higher. S&P Rising Wedge: One of the most bearish of all rally patterns is the rising wedge, a pattern we have highlighted several times over the past few weeks in the S&P 500 index. We have hypothesized that before this wedge gives way to selling, a strong upside breakout would occur in order to draw in bag holders. Yesterday we got the initial move of just such a breakout, as can be seen below.

Tuesday, September 26, 2006

As Long as Everyone is Bearish, This Rise Will Continue

Monday, September 25, 2006

Window Dressing Should Prop Up Weak Market

There remains potential for the S&P to test its highs this week. We will be surprised, but not completely shocked, if the QQQQ is able to also test its highs. We would use late week strength to look for short positions.

Finally, for those feeling a twitch of concern at our market outlook, consider that after a corrective retracement, the probabilities for a strong late year rally are very good.

There remains potential for the S&P to test its highs this week. We will be surprised, but not completely shocked, if the QQQQ is able to also test its highs. We would use late week strength to look for short positions.

Finally, for those feeling a twitch of concern at our market outlook, consider that after a corrective retracement, the probabilities for a strong late year rally are very good.

Friday, September 22, 2006

Market Cracks Some More

Thursday, September 21, 2006

SMH Fails to Make a New High

Wednesday, September 20, 2006

Monday's Scenario Still In Play

Tuesday, September 19, 2006

Buyers Still in Control/Tech May Have a Top

Monday, September 18, 2006

Support Test Coming Up

The QQQQ set up is a little more unclear as it has shown good relative strength lately.

The bottom line: We are seeing some good long set ups at this time that should continue higher over the next couple of weeks. As we enter October the market becomes more vulnerable to a larger correction. Should the above scenario play out like it looks like it might, the return to the summer lows will provide an excellent long term buying opportunity. Participants are likely to be extremely bearish at that point and those who play it cautious as the market makes its top here will be in great shape to capitalize at very good prices indeed.

The QQQQ set up is a little more unclear as it has shown good relative strength lately.

The bottom line: We are seeing some good long set ups at this time that should continue higher over the next couple of weeks. As we enter October the market becomes more vulnerable to a larger correction. Should the above scenario play out like it looks like it might, the return to the summer lows will provide an excellent long term buying opportunity. Participants are likely to be extremely bearish at that point and those who play it cautious as the market makes its top here will be in great shape to capitalize at very good prices indeed.

Friday, September 15, 2006

Watching and Waiting

Thursday, September 14, 2006

Pavlov's Lesson

Wednesday, September 13, 2006

Bulls Refuse to Give Up

Tuesday, September 12, 2006

Watching Tech's Head and Shoulders

Monday, September 11, 2006

Three Potential QQQQ Scenarios

If this is indeed the case, we should see the price bounce around between $38.00-$38.70 through options expiration, and then potentially break lower. Cup and Handle (bullish)

Friday, September 08, 2006

No Advantages to Forcing a Trade

Thursday, September 07, 2006

Stay Patient, Sentiment Will Swing Again

The tech sector will probably bounce from yesterday's lows, but now any rally attempts are very likely to get stuck in the mud and prices will begin working their way lower; frustrating any hopeful longs who buy the dips.

The SPY (S&P 500) moved down to support yesterday, but it has not yet provided a sell signal. Money flow perked up at the end of the day indicating that smart money has not yet determined that the rally is completely played out. There are just too many retail traders who have quickly jumped to the bear camp after yesterday's weakness. The market's perverse nature is likely to frustrate put option buyers by failing to provide immediate gratification.

If the SPY can break below the blue uptrend line it closed at yesterday, it will signal a sell.

The tech sector will probably bounce from yesterday's lows, but now any rally attempts are very likely to get stuck in the mud and prices will begin working their way lower; frustrating any hopeful longs who buy the dips.

The SPY (S&P 500) moved down to support yesterday, but it has not yet provided a sell signal. Money flow perked up at the end of the day indicating that smart money has not yet determined that the rally is completely played out. There are just too many retail traders who have quickly jumped to the bear camp after yesterday's weakness. The market's perverse nature is likely to frustrate put option buyers by failing to provide immediate gratification.

If the SPY can break below the blue uptrend line it closed at yesterday, it will signal a sell.

Wednesday, September 06, 2006

Be Careful Here

Tuesday, September 05, 2006

What September May Hold

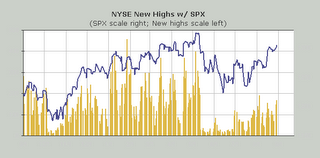

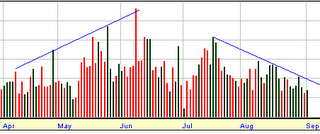

2. Likewise, the S&P 500 and Dow have rallied back to their April failure points. However, note the notable decrease in stocks making new highs during the latest rally (the yellow bars represent stocks making new highs, while the blue line represents the S&P price levels). This is a very strong bearish divergence, which makes a breakout to new highs very unlikely.