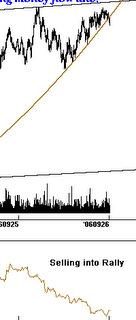

Also note the important break in the uptrend line yesterday, even as QQQQ shares traded higher. Adding insult to injury, the S&P 500 made a new 5-year high yesterday, while the NASDAQ lagged significantly. This type of bearish divergence has preceded each failed rally for several years now. Gaming Window Dressers: End of month window dressing has been increasingly gamed by traders who have learned the pattern. Not that long ago window dressing would result in rallies which took place during the last three days of the month, and sometimes extended into the first two trading days of the following month. Now, however, traders have been taking advantage of the rallies and selling into them during the later days, causing the rallies to start to fizzle during the last day or two of the month. If this pattern persists, it means that today should market the last day where window dressing is able to push the market higher. S&P Rising Wedge: One of the most bearish of all rally patterns is the rising wedge, a pattern we have highlighted several times over the past few weeks in the S&P 500 index. We have hypothesized that before this wedge gives way to selling, a strong upside breakout would occur in order to draw in bag holders. Yesterday we got the initial move of just such a breakout, as can be seen below.

No comments:

Post a Comment